In short its everything needed to minimize the risks and uncertainties exposed to that organization. Risk management is defined as identifying assessing prioritizing and mitigating risks associated with any undertaking.

Ppm Glossary What Is Risk Management

Ppm Glossary What Is Risk Management

COBUILD Key Words for Insurance.

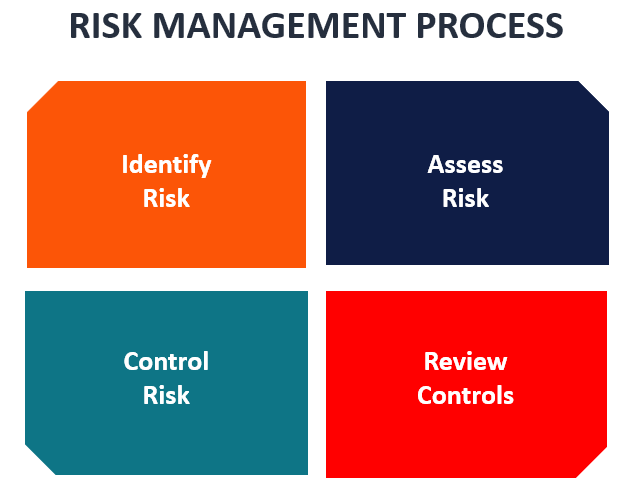

What is the definition of risk management. Risk management is the process of identifying assessing and controlling risks arising from operational factors and making decisions that balance risk costs with mission benefits. Your top risks and concerns need to be continually addressed to ensure your business is fully protected. Monitor Monitoring risk should be an ongoing and proactive process.

These threats or risks could stem from a wide variety of sources including financial uncertainty legal liabilities strategic management errors accidents and natural disasters. Risk management is focused on anticipating what might not go to plan and putting in place actions to reduce uncertainty to a tolerable level. Risk mitigation is defined as the process of reducing risk exposure and minimizing the likelihood of an incident.

Risk Management Step 4. A risk is the potential of a situation or event to impact on the achievement of specific objectives. Risk management is a system of preventing or reducing the likelihood that dangerous accidents or mistakes will occur or reducing the amount of money lost by the insurance company.

In financial dictionary for investor it is uncertainty of returns. Risk management is the process of evaluating the chance of loss or harm and then taking steps to combat the potential risk. Risk management is the process of identification analysis and acceptance or mitigation of uncertainty in investment decisions.

Uncertainties pose risks and opportunities with the potential to destroy or create value. Unlike most managerial systems risk management doesnt overlap. Whether that undertaking is a family reunion or a multi-billion dollar new.

Happening of which can cause loss or sort of harm. In the world of finance risk management refers to the practice of identifying potential risks in advance analyzing them and taking precautionary steps to reducecurb the risk. It is the process of bearing the risks we want to bear and reducing to a minimum our exposure to the risks we do not want.

Risk management refers to the forecasting and evaluation of financial and business risks as well as the identification of procedures and measures to avoid or minimize their potential impact. Copyright HarperCollins Publishers. Risk is inseparable from return in the investment world.

Enterprise risk management ERM is a plan-based business strategy that aims to identify assess and prepare for any dangers hazards and other potentials for disasterboth physical and. In recent years all sectors of the economy have focused on management of risk as the key to making organisations successful in delivering their objectives whilst protecting the interests of their stakeholders. Risk can be perceived either positively upside opportunities or negatively downside threats.

When an entity makes an investment decision it exposes itself to a number of financial risks. Tap again to see term. Risk management is the process of planning organizing directing and controlling the human and material resources of an organization.

Click again to see term. These risks differs in nature therefore there are different types of risks. Risk management is the identification evaluation and prioritization of risks defined in ISO 31000 as the effect of uncertainty on objectives followed by coordinated and economical application of resources to minimize monitor and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

Risk management is an organizational model aimed at developing the quality of management processes. Examples of potential risks include security breaches data loss cyber attacks system failures and natural disasters. Definition of Risk Management.

Definition of Risk Management Risk is an unexpected event. It stands out by analysing the events that have never materialized within the organization. Risk management is the process of identifying assessing and controlling threats to an organizations capital and earnings.

In business risk management is defined as the process of identifying monitoring and managing potential risks in order to minimize the negative impact they may have on an organization.

The Importance Of Risk Management In An Organisation

What Is Risk Management What Does Risk Management Mean Risk Management Meaning Explanation Youtube

What Is Risk Management What Does Risk Management Mean Risk Management Meaning Explanation Youtube

Project Management Guide Project Risk Management

Risk Management Definition Ppt Download

Risk Management Definition Ppt Download

Project Risk Management Definition 2

Risk Management Overview Importance And Processes

Risk Management Overview Importance And Processes

Effective Risk Management In Healthcare Practice

Effective Risk Management In Healthcare Practice

Chapter 1 Risk Management 2nd Semester M Com Bangalore Univer

Chapter 1 Risk Management 2nd Semester M Com Bangalore Univer

Lecture 2 Risk Management Process 1 Risk Management It Paves The Path For Project Management It Results In Analysis Of External Internal Situations Ppt Download

Lecture 2 Risk Management Process 1 Risk Management It Paves The Path For Project Management It Results In Analysis Of External Internal Situations Ppt Download