Usually venture capital comes from investment banks high potential investors and other such wells to do financial institutions. Venture Capitalists VC who make money for themselves by creating a market for the above 3 players in the industry.

These are types of investment funds that primarily target firms that have the potential to deliver high returns.

Types of venture capital. A VC may specialize in provide just one of these. Investors with an objective of securing very high returns. Investment bankers who need companies to sell.

Entrepreneurs who need funding. Limited Partners LPs is someone who commits capital to the venture fund. This investment is followed by middle and later stage funding the Series B C and D rounds.

Venture capital firms or funds invest in these early-stage companies. Venture capital firms create venture capital funds a pool of money collected from other investors companies or funds. The business often requires capital for initial setup or expansion.

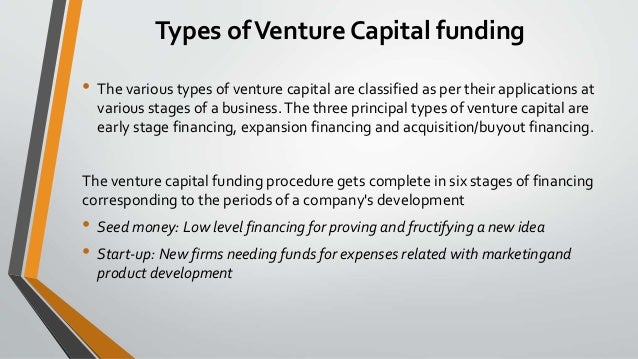

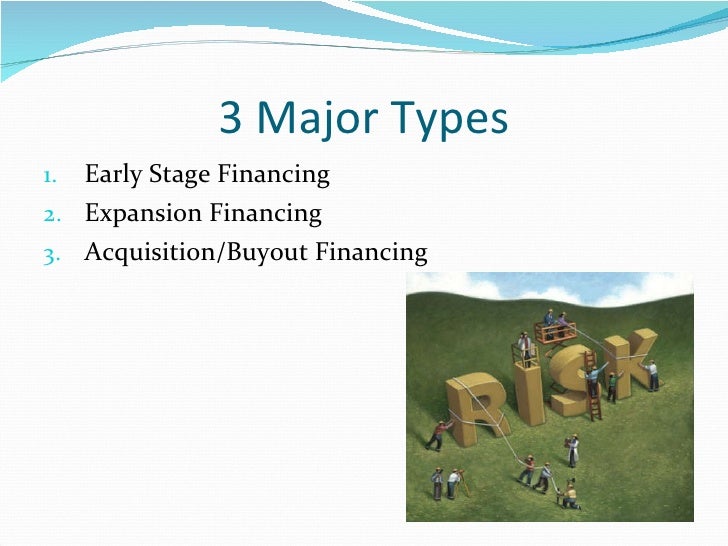

These firms also invest from their own funds to show commitment to their clients. The three principal types of venture capital are early stage financing expansion financing and acquisitionbuyout financing. Venture capital investing may be done at an even earlier stage known as the idea phase.

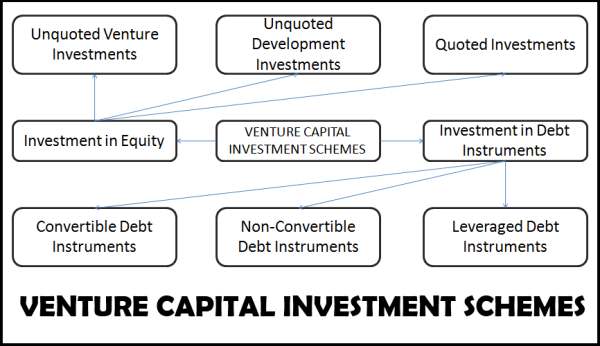

Venture capital is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Types of Venture Capital Funding By Alcor Mergers and Acquisitions Pvt Ltd 17th Oct 2017 The numerous sorts of working capital are classified as per their applications at various stages of. Venture capital funds VCFs are investment instruments through which individuals can park their money in newly-formed start-ups as well as small and medium-sized companies.

Some investors even partake of venture capital careers as an independent investor. Corporate Finance Training Advance your career in investment banking private equity FPA treasury corporate development and other areas of corporate finance. Venture capital is a type of financing and a part of private equity in which investors provide new and upcoming companies and also to small businesses that have the potential for long-term growth.

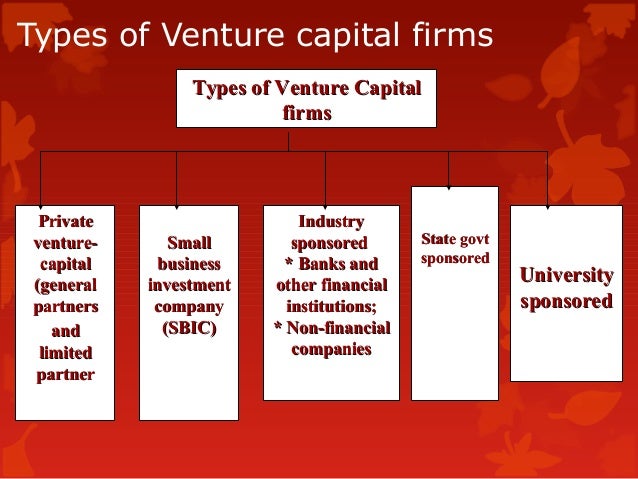

Include leveraged buyouts LBO venture capital growth capital distressed investments and mezzanine capital. Types of Venture Capital VC can be categorised as per the stage in which it is being invested. The first professional investor to a deal at the start-up stage is referred to as the Series A investor.

The different types of venture capital financing depends on the investment of specific purpose within the life of target company as the high return rate of the company remains constant and it has no effect on it. There are three types of venture capital financing-. There are three main categories of venture capital financing each with its own subcategories.

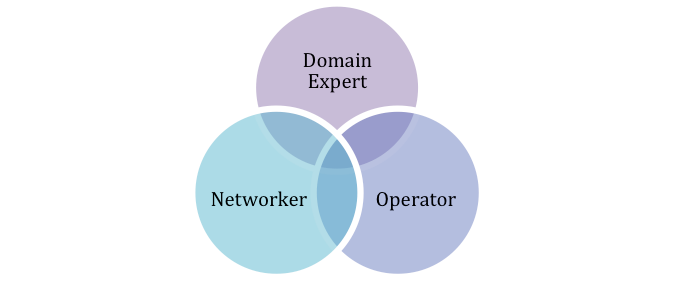

Venture Capital VC industry has 4 main entities which are mentioned below. LPs are mostly institutional investors such as pension funds insurance companies endowments foundations family. Venture capital is funding given to startups or other young businesses that show potential for long-term growth.

The final rounds include mezzanine late stage and pre-IPO funding. Private equity and venture capital buy different types of companies invest. The venture capital funding procedure gets complete in six stages of financing corresponding to the periods of a companys development.

Early-stage financing is also divided into three parts. Venture capital is a subset of private equity and refers to equity investments made for the launch early development or expansion of a business Among different countries there are variations in what is meant by venture capital and private equity In Europe these terms are generally used interchangeably and venture capital thus includes management buy-outs and buy-ins MBOMBIs. Venture capital jobs are sometimes offered through a venture capital firm and often involve the management of a private venture capital fund.

Venture capital investing is a type of private equity investing that involves investment in a business that requires capital. Venture Capital vs Angel Investors While both types of investors provide capital to startup companies there are several important differences between venture capitalists and angel investors. Common strategies within PE.

The biggest difference is that venture capital comes from a firm or business while angel investments come from individuals. Types of Venture Capital Funding. The scope of duties within venture capital jobs varies with some requiring the financing of a small start-up company while others may involve the acquisition and.

Venture capital VC is a form of private equity financing that is provided by venture capital firms or funds to startups early-stage and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth in terms of number of employees annual revenue scale of operations etc.

Venture Capital Is A Type Of Equity Financing That Addresses The Funding Needs Of Entrepreneurial Companies Tha Venture Capital Startup Funding Angel Investors

Venture Capital Is A Type Of Equity Financing That Addresses The Funding Needs Of Entrepreneurial Companies Tha Venture Capital Startup Funding Angel Investors

Types Of Investments By Venture Capital Institutions Vci

Types Of Investments By Venture Capital Institutions Vci

Venture Capital Features Types Funding Process Examples Etc

Venture Capital Features Types Funding Process Examples Etc

Different Types Of Venture Capital Sorting It Out Once And For All M51

Different Types Of Venture Capital Sorting It Out Once And For All M51

Venture Capital Features Types Funding Process Examples Etc

Venture Capital Features Types Funding Process Examples Etc

Various Types Of Venture Capital Investment Young Naija Entrepreneurs

Types Of Venture Capital Funding By Alcor Mergers And Acquisitions Pvt Ltd Issuu

Types Of Venture Capital Funding By Alcor Mergers And Acquisitions Pvt Ltd Issuu

Venture Capital 101 Structure Returns Exit And Beyond By Pocket Sun Sogal Medium

Venture Capital 101 Structure Returns Exit And Beyond By Pocket Sun Sogal Medium

Ppt On Venture Capital And Its Types

Ppt On Venture Capital And Its Types

Venture Capital Features Types Funding Process Examples Etc

Venture Capital Features Types Funding Process Examples Etc